Here are a number of questions we have received about the proposed 2024 bond election. If you have a question you would like included please reach out to us at ask@lisd.org

A bond is similar to a home mortgage. It is a contract to repay borrowed money with interest over time. Bonds are sold by a school district to competing lenders to raise funds to pay for the costs of construction, renovations and equipment. Most school districts in Texas utilize bonds to finance renovations and new facilities.

Bond funds can be used to pay for new buildings, additions and renovations to existing facilities, athletic structures, land acquisition, technology infrastructure and equipment for new or existing buildings. Bonds cannot be used for salaries or operating costs such as utility bills, supplies, building maintenance, fuel and insurance.

Planning for the district’s current and future needs is one of the fundamental duties of school boards and district administrators. As such, there is a constant evaluation of facilities and other needs in light of the age of district-owned structures, changes in technology, and even changes in instruction. When the district determines that it has needs beyond the capacity of the maintenance and operations budget, the Board of Trustees may issue a bond. The maintenance and operations budget covers the day-to-day expenses of the district, where over 80 percent is directed toward staff salaries and benefits.

The Texas Education Agency in the Financial Integrity Ratings System of Texas (Schools FIRST Rating) sets the guidelines for school districts to have three months of operating expenditures in fund balance. Maintaining the required fund balance as well as the operational needs of the district (with limited state funding) may restrict districts from building adequate savings to fund facilities and infrastructure needs to accommodate construction costs of building a new facility or repairing and renovating an older one.

Homeowners borrow money in the form of a mortgage to finance the purchase of a home. A school district borrows money in the form of bonds to finance new schools and renovation projects. Both are repaid over time, but in order for a school district to sell bonds (borrow money) it must go to the voters for approval. By law, bond funds may not be used to fund daily operating expenses or salaries. Bond funds may only be used for the projects described.

The State Property Tax Code allows for school property taxes on an individual homestead to be “frozen” at the age of 65. If you are 65 years of age or older and you have filed for the “Over 65 Homestead Exemption”, there is a ceiling on the amount of school taxes to be paid. The only exception is if improvements are made to a home. As such, a tax increase from a new bond program cannot increase the applicable tax ceiling of a taxpayer that has qualified for the “Over 65 Homestead Exemption” unless improvements are made to the home.

Since 2019, state law requires all bond propositions for any school district to have the phrase "THIS IS A PROPERTY TAX INCREASE" on all ballot language for bond propositions. Homeowners age 65 & older who have filed for and received the Over 65 exemption will not see an increase over their frozen dollar amount. Check your most recent Notice of Assessed Value Change to see if you will be impacted.

Any registered voter who lives within the Longview ISD boundaries — and whose voter

registration is based on their current LISD residence — is eligible to vote in this bond election.

The deadline to apply for voter registration is April 4, 2024 in order to vote in the May 4, 2024 election.

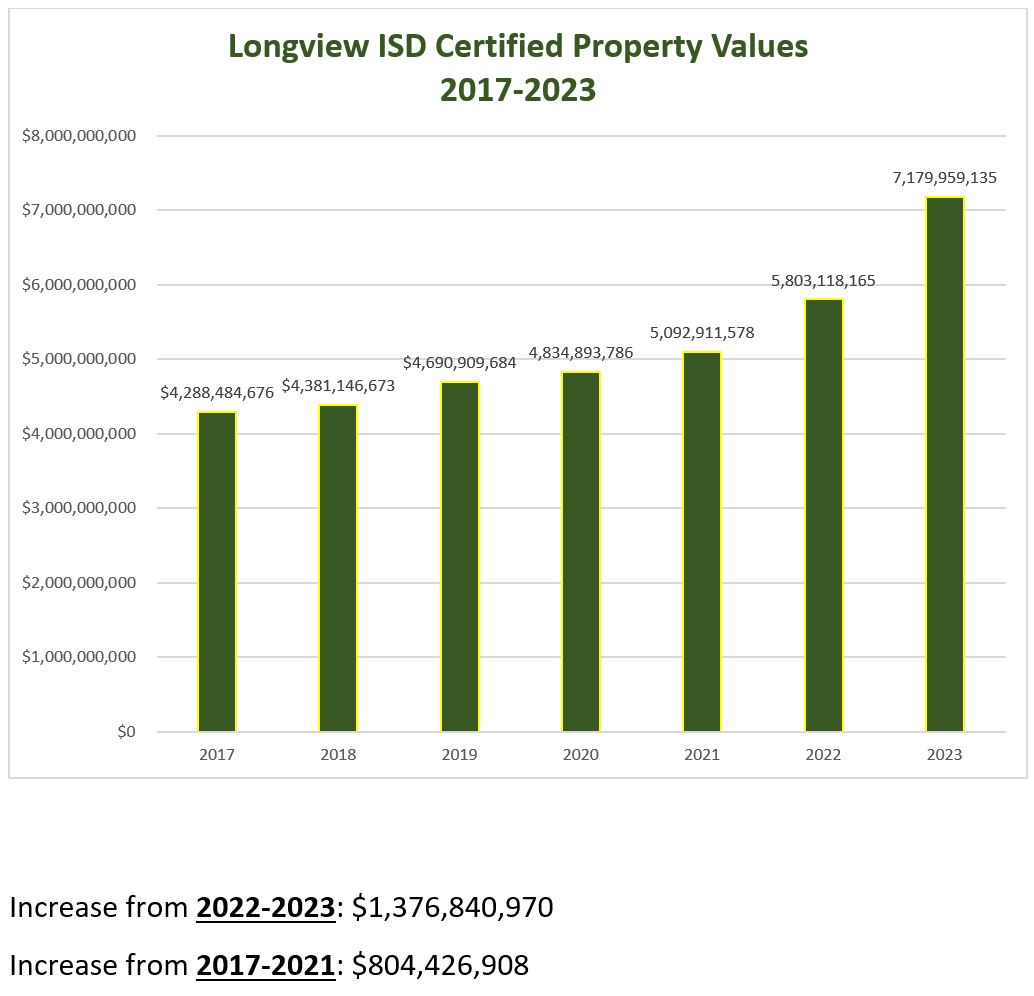

The price of the bond has increased since the November 2023 election. However, the district isn't asking for additional funding since then. For the November election, the district used the 2022 property value of $5,803,118,165 in its calculations. In 2023, LISD experienced historic growth in property values, increasing by $1.3 billion. This growth made up for the additional funds needed for the projects.